MARKET OVERVIEW

Navigating the Global Demand: Gallium, Germanium and Rare Earths

Global Demand

- Canada and the US signed a partnership to strengthen resilience of Critical Mineral and Semiconductor supply chains.

- The Pentagon plans to issue a first-time contract to US or Canadian companies by year-end to recover gallium.

- With the passage of the CHIPS and Science Act, the United States and Canada will facilitate investment to promote secure and resilient semiconductor supply chains.

- China produces a staggering 98 percent of the world’s supply of raw gallium.

- Western countries have ramped up support to boost domestic production of critical minerals to reduce reliance on China.

Gallium Critical to Modern Economies

Gallium Plays a Unique Role in Modern Military Systems

The United States and other advanced economies purchase gallium from China and refine it further for use in commercial and military applications.

Gallium compounds are key inputs to some advanced U.S. defense systems and, by extension, the DOD supply chain.

Gallium-based semiconductors are vital to the U.S. defense industry, particularly in next-generation missile defense and radar systems, as well as electronic warfare and communications equipment.

GaN (Gallium Nitride) is foundational to nearly all the cutting-edge defense technology that advanced countries produce.

Gallium Market

Gallium Market Analysis

By Market Players, 2022-2023

- Gallium compounds are used in semiconductor materials, optoelectronic devices (e.g., laser diodes, light-emitting diodes photodetectors, and solar cells), cancer and malaria chemotherapy, antimicrobial, and dental materials.

- The growing use of Gallium in the electronics sector is propelling sales opportunities in the market.

- North America is estimated to hold the leading position in the global gallium market. This is due to the rise in demand of electronic consumer goods.

Gallium & Germanium Market Dominated by Chinese

China has started restricting exports of gallium, which is key to the semiconductor industry, as the chip war with the US and Canada heats up

- Under new controls, exporting gallium and germanium from the world's second-largest economy now requires special licenses.

- These materials, crucial for chip production and with military applications, fall under the scope of the new regulations.

- China dominates the global gallium and germanium supply chain, producing 80% and 60%, respectively, as reported by the Critical Raw Materials Alliance (CRMA).

- China has imposed restrictions on U.S. firms associated with the American military, including aerospace company Lockheed Martin.

- While the U.S. possesses reserves of germanium, it lacks a stockpile of gallium.

- The U.S. has announced the enforcement of licenses for companies exporting chips to China using U.S. tools or software, regardless of their global production location.

“Quite simply, if you won’t give us chips, we won’t give you the materials to make those chips”

– Colin Hamilton, BMO Investment

USA & Canada Partnership

Export Restrictions and Pentagon Contract

Due to Chinese export restrictions, the Pentagon plans to issue a first-time contract by year-end to recover gallium—a vital mineral for semiconductors and military radar systems—from U.S. or Canadian companies.

Energy Resource Governance Initiative (ERGI)

Canada and the U.S. signed an MOU confirming Canada’s participation in ERGI, a multi-pronged strategy to reduce reliance on China’s critical energy minerals monopoly.

Resilient Supply Chains

Collaborative efforts between the U.S. and Canada aim to establish a strong, environmentally responsible, and resilient North American critical minerals supply chain.

Investments and Funding

USD $50 million in Defense Production Act funding announced for U.S. and Canadian companies, along with CAD $250 million from Canada’s Strategic Innovation Fund for semiconductor projects.

CHIPS and Science Act Impact

The U.S. and Canada will facilitate investment to bolster secure semiconductor supply chains, creating jobs and advancing a cross-border packaging corridor.

Support for Canadian Companies

Canadian companies in critical minerals for electric vehicles and storage batteries are eligible for USD $250 million Defense Production Act Title III funding.

The Importance of Rare Earths Across Industries

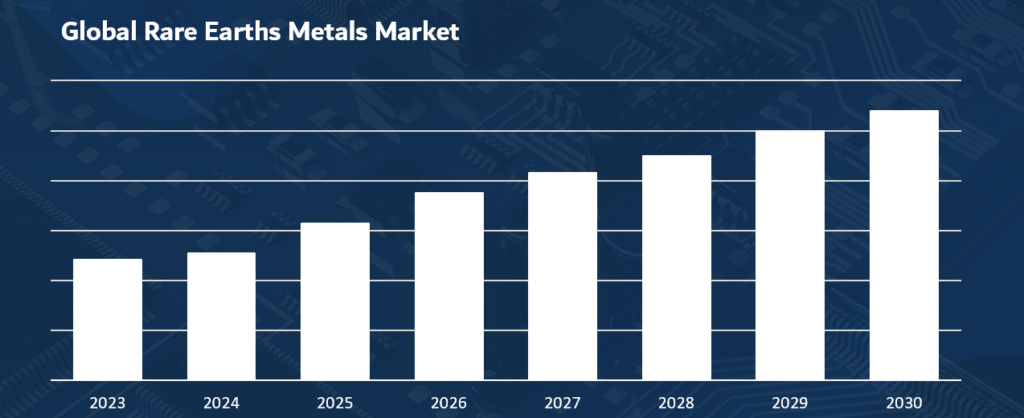

Rare Earth Metals Market

Chipmaking Making Metals

Critical Elements for Chipmaking Production Linked to LCT Pegmatite Emplacement

Gallium: Gallum’s most prominent use in technology is in the form of Gallium Arsenide (GaAs), a compound semiconductor. GaAs are highly valued in the electronics industry for its superior electron mobility compared to silicon, making it ideal for high-frequency, high-efficiency applications like mobile phones, satellite communications, microwave point-to-point links, and some radar systems. Additionally, gallium is also used in the production of Gallium Nitride (GaN), another semiconductor with applications in LEDs, laser diodes, and high-power transistors. The unique properties of gallium-based semiconductors, such as their ability to operate at higher temperatures and their efficiency in converting electricity into light, make them critical in the advancement of various electronic and optical devices.

Tantalum: This metal is valued in chipmaking for its high melting point, excellent conductivity, and resistance to corrosion. Tantalum is often used in capacitors and high-power resistors found in semiconductor devices. Its ability to form stable oxide layers makes it ideal for use in thin-film components.

Beryllium: Beryllium is used in certain applications due to its unique properties. It has a high thermal conductivity, which makes it useful in thermal management applications within semiconductor devices. Beryllium is also used in some specialized applications where its light weight and rigidity are beneficial, such as in certain types of aerospace electronics. However, it’s important to note that Beryllium is highly toxic, and its use is highly regulated in manufacturing environments due to the health risks it poses when inhaled as dust or fumes.

Critical Uses

Companies directly affected by chipmaking metals and Supply Chain

- Nvidia, Taiwan semi-conductor, and Intel are some of the largest semiconductor manufacturers and heavily rely on gallium to keep up with the massive demand, especially due to AI

- Apple, Microchips and semiconductors

- Tesla, microchips in cars

- Open AI, heavily uses semiconductors to power its technologies

Ontario’s Role in Critical Minerals

Abundant Critical Minerals

Thriving Mining Industry

Canada and the U.S. signed an MOU confirming Canada’s participation in ERGI, a multi-pronged strategy to reduce reliance on China’s critical energy minerals monopoly.